Many supply chains extend from buyers in Germany to the rest of the world using Incoterms. These internationally applicable trade clauses ensure legal certainty among the partners. Which are more favorable for local procurers? CIF Incoterms or FOB Incoterms? The answer is in the details.

Incoterms in international trade

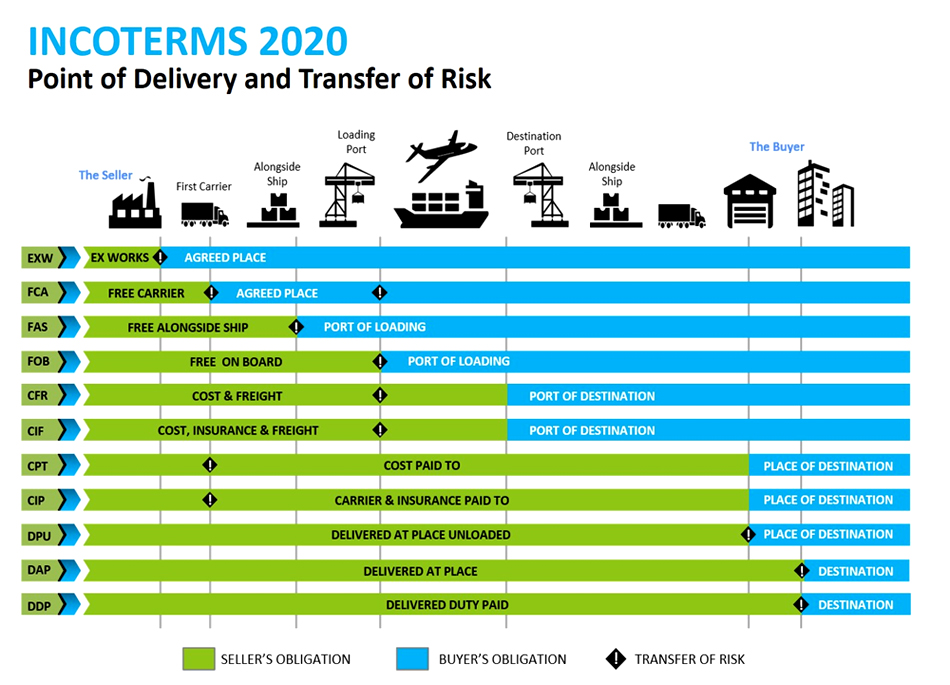

Current Inctoerms - Source: aademc.com

Fair trade in goods is based on rules that the partners involved agree upon and abide by. When it comes to cross-border trade, we talk about International Commercial Terms, or Incoterms for short. They were first defined by the International Chamber of Commerce (ICC) in 1936. They are now revised and updated every ten years. The most recent reform came into force on January 1, 2020. Incoterm contracts are not mandatory, but are concluded on a voluntary basis. However, they are then binding.

There are eleven Incoterms in total, two of which are particularly important for maritime transport. This is why they play a major role in business with Chinese suppliers, for example. These are the Incoterms CIF for Cost, Insurance and Freight and FOB for Free On Board. They describe which obligations buyers and sellers must fulfill at which stage of the trade.

The core issue is who bears responsibility for the goods until they arrive at the port of destination (transfer of risk). This concerns the assumption of:

- Transportation costs

- Insurance costs

- Shipping risks

CIF: obligations of the buyer and seller

According to the CIF Incoterms, the seller, i.e. the supplier, is largely responsible for the freight and the costs incurred in the process. In detail, he has the following obligations until the ship arrives at the buyer's port of destination:

- Delivering the goods

- Providing the necessary documents

- International transportation in the exporting country to the port of destination in the importing country

- Payment of customs duties in the exporting country

- Expedition fee of the ship

- Assumption of insurance costs

Upon arrival at the port of destination, the risk is transferred from the seller to the buyer. The buyer is responsible for

- Payment of the goods

- Assumption of costs for the receipt of the goods

- Payment of customs duties in the importing country

- Transportation in the country of import

- Assumption of other costs incurred

- Transportation costs

- Insurance costs

- Shipping risks

CIF and FOB: A subtle difference

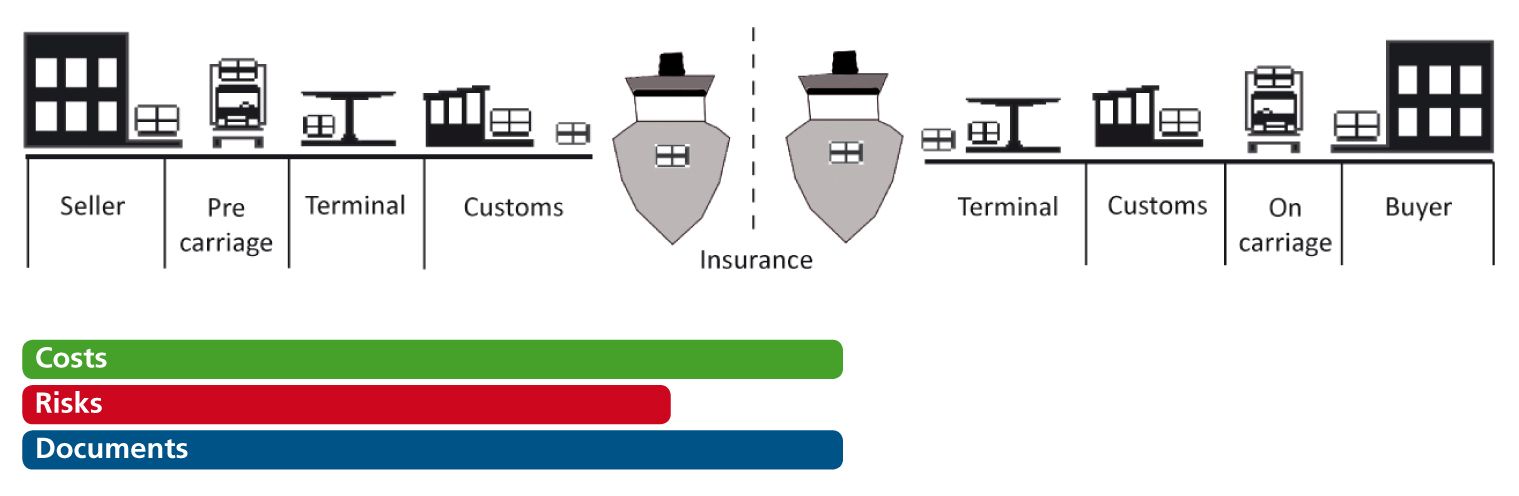

How CIF works - Source: internationalcontracts.net

Compared to CIF Incoterms, FOB Incoterms partially shift responsibilities between the procurer and the supplier. Accordingly, the obligations for the seller are as follows:

- Delivering the goods

- Providing the necessary documents

- Transport in the export country

- Assumption of costs for customs in the export country

- Outgoing fee of the ship

For the buyer these responsibilities result from it:

- Payment of the goods

- International transportation from the port of departure to the port of destination

- Assumption of costs for the receipt of goods

- Assumption of costs for customs in the importing country

- Transport in the importing country

- Assumption of insurance costs

- Assumption of other costs incurred

The difference between CIF-Incoterms and FOB-Incoterms: Under FOB terms, the responsibility for international delivery of sea freight is transferred from the seller to the buyer. This means that the latter bears the transportation costs and risks, as well as being responsible for the transportation arrangements. Therefore, CIF Incoterms may seem simpler and more practical from a procurement perspective. And at first glance, they are often less expensive. However, FOB Incoterms can be more advantageous for the procurer.

- The buyer gets control over transport costs and risks of the goods earlier and can, for example, determine a carrier for the delivery himself. He therefore has more influence over cost, insurance and freight and is less dependent on the seller's agreements. This is because the seller does not necessarily act in accordance with the purchaser's wishes.

- Especially in business with Chinese partners, CIF costs are often not as low as initially expected. This is due to the following practice of some exporters: They interpose a customs agent in the supply chain, who is listed as the consignee in the bill of lading. He only hands over the goods to the buyer at the port of destination. This means that the buyer has no prior right to the shipment. In addition, customs agents sometimes charge high premiums for the handover, which they share with the seller and which can significantly increase the total price. This practice is now used not only in China but also in other countries, for example in Latin America. Under these circumstances, FOB Incoterms are often more favorable for the buyer.