At FoodPorty, we don't conduct business without a Letter of credit having been issued. So even if a buyer is ready to pay upfront, we don't agree on those terms. But what is a Letter of credit and why do you need it? This contribution will help you.

Letter of credit in Agricultural trade

Letter of credit is one of the most versatile and secure instruments available to international traders. According to bankread.com letter of credit has been utilized for more than 150 years and its origin being traced to the European nations. Whether in agricultural sector, fashion and retail, manufacturing or building and construction industry, letter of credit can provide business with extensive trading opportunities across the globe. In this article, we purposely aim to explore more about the letter of credit, its types and how it is being issued. Furthermore, we will analyze on some of its advantages in agricultural trade and finally the possible shortcomings and issues involved in using the document.

So, what is the letter of credit?

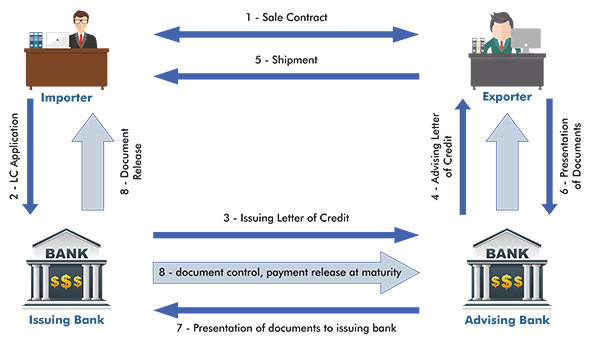

Before we answer this, we first need to identify different parties involved in the letter of credit, these parties include; the exporter of agricultural commodities, the importer of the agricultural commodities, the importers bank or the issuing bank and the exporters bank. It is worth noting that the banks here deal exclusively on the documents only and does not in any way deal with goods. That being said, letter of credit therefore is a security document issued by a financial institution and is used to raise funds for agribusiness. This is a dedication by a bank on behalf of the foreign importer who is a buyer that payment will be made to the seller who is an exporter of agricultural commodities provided that the terms and conditions stated in the letter of credit have been met as evidenced by the presentation of specified documents.

Letter of credit in all forms

How the Letter of Credit works - Source: miro.medium.com

Irrevocable letter of credit

As the name implies, irrevocable letter of credit cannot be amended or terminated without the consent of the issuing bank.

Revocable letter of credit

Unlike the irrevocable letter of credit, this one can be amended or cancelled at any time by the issuing bank without notifying the beneficiary. In most cases, the revocable letter of credit does not have security payment and it is a subject to termination without any consent. Other types of letter of credit include the following; freely negotiable letter of credit, restricted negotiable letter of credit and revolving letter of credit.

Advantages of using Letter of Credit

Letter of credit gives assurance to the buyer’s bank to remit the amount to the seller through the seller’s bank on maturity based on the contractual agreement and terms and conditions of document between the seller and the buyer. When the seller opens the letter of credit in his name he or she will receive the amount through the buyer’s bank at the agreed time. All Letter of Credit for export-import trade is handled under the guidelines of Uniform Customs and Practice of Documentary Credit of International Chamber of Commerce. A Letter of credit from a bank guarantees that a seller will receive payment as long as certain conditions are met. If a foreign buyer changes or cancels an order, for example, a letter of credit ensures that the seller will still get paid by the buyer’s bank for the shipped goods, thus reducing production risk.

Act as a security

A Letter of credit is also a safeguard against situations where a buyer refuses to pay for goods, or if a buyer goes bankrupt (Schmidt-Eisenlor, 2013). It also serves as proof to your supplier that you will fulfill your payment obligations. This is especially valuable if your agricultural trade needs supplies or equipment on a tight schedule, and you absolutely cannot afford any transaction-related delays. Letter of credit is highly customizable in a way that the buyer and seller can work out a mutually acceptable set of payment terms for a particular transaction. If a different set of payment terms are required for a separate business transaction, the buyer’s bank can customize a different agreement for that purpose. An LC also gives overseas buyers the flexibility of deciding when the shipment of goods should take place (Kim, 2021). Having a letter of credit in place will ensure sellers receive payment on time, which can go a long way in helping them manage their cash flow. Furthermore, sellers can obtain financing between the shipment of goods and receipt of payment, which can provide an additional cash boost in the short term.

Shortcomings of Letter of Credit

Always check your Letter of Credit (LC) in detail - Source: pexels.com

High Costs

A letter of credit adds to the cost of doing business. For the agricultural producers in the developing countries mostly in Africa and Asia, the use of letter of credit is found to be very costly and most farmers cannot afford. Banks charge a relatively higher fee for providing this service this makes the letter of credit to be costly.

The Issue of Credit Worthiness

Determining the creditworthiness of the customers is very hard, this is because when using letter of credit essentially transfers the creditworthiness from the importer to the issuing bank. In case the issuing bank defaults, the exporter still risks not to get payment (Ahn, 2020).

The Fraudsters Issue

There have been cases of reported fraudulent activities related to the use of letter of credit especially in the developing countries. The fraudsters forge the letter of credit to defraud the agricultural commodities and the producers end up losing their products and funds.

It is so bureaucratic

Obtaining the letter of credit is excessively complicated and involves a lot of processes which is not so much favorable for agricultural traders. For the letter of credit to be valid it must be attached to other documents such as; bill of lading, airway bill, certificate of origin, packing list and sometimes commercial invoice. Obtaining all these documents takes a lot of time. It is because of these complicated processes that makes the letter of credit unfriendly especially when the need of the products is very urgent. In addition, in international business, due to different cultures, laws, systems, and practices between two countries, in case of any conflict and issues between the exporter and importer it is often difficult for the victims to get justice.

The Bottom Line

Letter of credit is mostly used across the globe when dealing with the international trade, it is the most secure method of payment and arguably the most preferred method of payment because the primary risk is held by the financial institution. The international chamber of commerce (ICC), should come up with a body to handle all letter of credit issues. Additionally, the body should draft and formulate clear code of conduct and policies to mitigate all the issues faced by the traders. Furthermore, the financial institution should appropriately register the underlying asset which is held as collateral in case of bank default, the underlying asset is pledged to the final investor by law, who can then sue for the property when the bank does not pay the asset.

References

- References Ahn, J. (2020). A theory of domestic and international trade finance. Emerald Publishing Limited.

- Kim, S. M. (2021). UCP and Letter of Credit Examples. In Payment Methods and Finance for International Trade (pp. 111-127). Springer, Singapore.

- Kurkela, M. S. (2007). Letters of credit and bank guarantees under international trade law. OUP Catalogue.

- Schmidt-Eisenlohr, T. (2013). Towards a theory of trade finance. Journal of International Economics, 91(1), 96-112.